top of page

THE RH JOURNAL

Insights and Articles

April Market Review

Market Performance for the Month of April S&P 500-0.67% NASDAQ0.88% DOW 30-3.08% All economic numbers and information discussed in this article are provided by our research partners Bespoke and YCharts. If there’s one word to describe the stock market over the past few months, it’s volatile. Within this year, we have experienced a 15% market […]

Christian Hutchins CFP®, CEPA®, AIF®

Jun 2, 2025

Family Traditions

As we close out April, it’s hard for me to reflect on the past month without thinking about family traditions. Every year, April kicks off with the Masters golf tournament in Augusta, Georgia, which to me, a poor golfer with no affinity for the Golf Channel, has always stood as the pinnacle of tradition in […]

Christian Hutchins CFP®, CEPA®, AIF®

Jun 2, 2025

Avoid Whiplash! Sharp Rally Highlights Importance of Balanced Positioning

As management theorist and author Peter Drucker said, “The greatest danger in times of turbulence is not the turbulence, it is to act with yesterday’s logic.” April saw a whirlwind of surprising news flow causing investors to suffer a commensurate roller coaster ride in stock price behavior. Let’s review April’s catalytic events and associated price […]

Jeff Krumpelman, CFA®

May 2, 2025

Respect Rising Risk and Volatility, but Hold Your Ground

Stock price behavior felt a little crazy in March, sort of like the madness of a recent college basketball tournament, as the S&P 500 index declined in price by roughly 5.8% for the month and the tech laden Nasdaq composite index price was off roughly 8.2%.1 It got even crazier in early April following the President […]

Jeff Krumpelman, CFA®

Apr 7, 2025

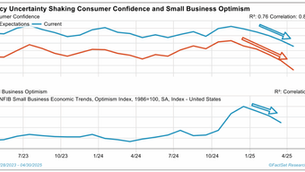

Clear Air Turbulence or an Ugly Lasting Storm? Hold your Ground!

2025 has simply been boring and status quo, right? There’s not much going on in the world or in the headlines. Not! We want to make sure you are awake as you start to read this. As we anticipated, the amount of news flowing out of Washington on the policy front this year has been […]

Jeff Krumpelman, CFA®

Mar 6, 2025

Economic Outlook: Initial Take on Trump’s Four Buckets

I feel better about some of my past economic calls that haven’t panned out. Theodore Roosevelt’s quote—“The only man who never makes a mistake is the man who never does anything”—gives me some degree of solace. My mistakes show that I am at least willing to make a call. My regular readers may remember that […]

William Greiner

Feb 7, 2025

What Does It Mean to Be from Los Angeles?

The city of Los Angeles, along with the county that shares its name, spans 4,060 square miles and is home to more than 9.6 million people, over 1,500 schools, and no racial majority. Los Angeles County’s population is larger than that of 40 U.S. states. To say that Los Angeles is vast and diverse barely […]

Christian Hutchins CFP®, CEPA®, AIF®

Feb 4, 2025

Santa Hit Some Air Turbulence at Year-End. Time for a Rest? Buckle Up!

“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.” — World-renowned management consultant and author Peter Drucker From an investment return standpoint, 2024 was virtually a replay of 2023. Specifically, the S&P 500 returned a total of 25.0% in calendar year 2024, almost identical to 2023’s […]

Jeff Krumpelman, CFA®

Jan 3, 2025

Too Much of a Good Thing in 2024—Or Riches Deserved?

It is possible to have too much of a good thing.” – Greek storyteller Aesop “Too much of a good thing can be wonderful.” – Actress and comedian Mae West A potential Santa Claus rally and post-election bounce that typically appears in the final two months of the calendar year got off to a nice […]

Jeff Krumpelman, CFA®

Dec 4, 2024

Trick or Treats as We Move Into Late Fall? Perhaps a Bit of Both.

“I used to think that if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I would like to come back as the bond market. It can intimidate everybody.” —Well-known political strategist James Carville In prepping for this month’s commentary, I did […]

Jeff Krumpelman, CFA®

Nov 6, 2024

September Fed Rate Cut Melt-Up: Warranted—or Prelude to an October Meltdown?

Statler (S): That was the worst thing I ever heard! Waldorf (W): It was terrible! S: Horrendous! W: Well, it wasn’t that bad. S: Oh, yeah? W: Yeah, it was GOOD, actually. S: Yeah, bravo! S & W: More!! — Excerpt from well-known Statler and Waldorf “Muppets” characters’ skit After a slow start in the […]

Jeff Krumpelman, CFA®

Oct 2, 2024

In The End, Rational Thinking Prevails. We’re Maintaining Our Constructive Thesis.

“It doesn’t matter how smart you are unless you stop and think.” —Well-known economist Thomas Sowell Nothing like a little head-spinning drama, eh? That’s what we saw in August as virtually one or two slightly disappointing economic numbers sparked a more than 10% pullback in the technology-laden Nasdaq and pushed the S&P 500 down close […]

Jeff Krumpelman, CFA®

Sep 4, 2024

The Economy Looks “Just Right” Despite Mixed Signals

“Our Earth is degenerate in these later days; bribery and corruption are common; children no longer obey their parents; every man wants to write a book, and the end of the world is evidently approaching.”– Assyrian tablet, circa 2800 B.C. These days, we are living through a period of high political tension. The national […]

Jeff Krumpelman, CFA®

Aug 1, 2024

Breaking News: It’s OK! Our “Back to Normal” Theme Is Alive and Well.

“It’s déjà vu all over again.”— Yogi Berra The first six months of 2024 were equally as kind to investors as the first six months of 2023. And that’s saying something, knowing that calendar-year total return in 2023 for the full year exceeded 26%.1 Returns for the S&P 500 in both six-month periods at the start […]

Jeff Krumpelman, CFA®

Jul 8, 2024

A Merry May on the Heels of an Awful April. The Merits of Staying Measured

“It’s the economy, stupid!” —Slogan coined by James Carville, well-known campaign strategist, and former President Bill Clinton during the 1992 presidential campaign April showers brought May flowers, indeed. The S&P 500 advanced over 4% in May following a decline of that same magnitude in April.1 This past month was a nice “in your face” start to […]

Jeff Krumpelman, CFA®

Jun 7, 2024

An April Air Pocket – No Fun, But Normal and Perhaps Even Healthy

“Some things are believed because they are demonstrably true. But many other things are believed simply because they have been asserted repeatedly—and repetition has been accepted as a substitute for evidence.” —Well-known economist and author Thomas Sowell April just wasn’t any fun. The S&P 500 fell 4.2% in the month, its worst monthly showing since […]

Jeff Krumpelman, CFA®

May 6, 2024

From Santa to the Easter Bunny: Rally Momentum or Melt-Up Zone Ahead?

“Sell in May and Go Away.” — An old investment adage with roots dating back to 18th century England. Also known as the “Halloween Indicator.” The Santa Claus rally that started in October 2023 and saw the S&P 500 surge by 14% in last year’s final two months,1 including a record-setting 10 consecutive weeks of gains in […]

Jeff Krumpelman, CFA®

Apr 4, 2024

Looking for a Melt-Up, a Meltdown, or Just a Solid Year? We Like Door No. 3!

“We’re runnin’ outta timeSo, tonight we’re gonna party like it’s 1999.” – Lyrics from Prince’s song and album of the same name, “1999” The inspiration for famous singer Prince in producing his hit song “1999” emanated from a documentary he saw about Nostradamus, a 16th century French astrologer who predicted various future global catastrophes, including several […]

Jeff Krumpelman, CFA®

Mar 6, 2024

Can the 2023 “Goldilocks” Economy Continue in 2024?

The numbers are in—no more guessing about growth levels or inflation rates for 2023. That is all in the rearview mirror (not counting upcoming adjustments to historical gross domestic product (GDP) growth rates). Many are suggesting the U.S. economy is experiencing a reasonably rare “Goldilocks” environment, meaning a “just right” level of inflation and growth. […]

Jeff Krumpelman, CFA®

Feb 5, 2024

Solid Results and Finish to 2023. Back to Normal Is Our Theme for 2024.

Our theme for the equity market as we approached 2023 was: 2023 is likely to be the inverse of 2022. We’re deeply gratified that this became reality. Unlike many, we expected solid results for stocks this past year, and that is exactly what investors got. This cheer came on the heels of 2022, which saw […]

Jeff Krumpelman, CFA®

Jan 4, 2024

bottom of page