top of page

THE RH JOURNAL

Insights and Articles

Insights

The November market pause just might set the table for a profitable 2026

The S&P 500 finished November up 0.2%, bringing year to date returns to 17.8% through month end. A flat month on the surface doesn’t quite capture the experience investors lived through, as it took a late-month rally to pull the index back to where it started. Beneath the headline number, some of the year’s high-flying […]

Jeff Krumpelman, CFA®

Dec 8, 2025

Trick or treat: A mixed bag

October could best be described as a mixed bag: some good, some bad, but certainly eventful. The month’s headlines and market reactions once again reinforced our Clear Air Turbulence theme, as investors navigated through some spooky developments: renewed government shutdown threats, chatter about stock market “bubbles” and talk of additional tariffs that led to a […]

Jeff Krumpelman, CFA®

Nov 7, 2025

The Fed Talks the Talk, Walks the Walk: Investors Embrace the Fed’s Decision

Mark Twain once said that September is a particularly difficult month to invest in stocks. Of course, he went on to comment jokingly that the other 11 difficult months included all other 30-day periods that comprise the calendar. Well, not true this September. The S&P 500 advanced over 2% for the month, and its current […]

Jeff Krumpelman, CFA®

Oct 6, 2025

The “Center Stage” Question: To Cut or Not to Cut? Market Implications

The current market set-up and drama surrounding the Federal Reserve (the Fed) is center stage right now and about as Shakespearean as it gets. In this unfolding monetary policy play, Fed Chairman Jerome Powell is seemingly cast in the role of Hamlet. Taking some license with that famous soliloquy in the actual play, the poetic […]

Jeff Krumpelman, CFA®

Sep 8, 2025

Your Personal Balance Sheet: Prioritizing Assets vs. Liabilities

At Rolling Hills Advisors, we require all our clients to maintain a personal balance sheet—an organized summary of the assets they own and the liabilities they owe. While this is a standard requirement for publicly traded companies, many individuals have never taken the time to put it on paper. We believe this simple but essential […]

Christian Hutchins CFP®, CEPA®, AIF®

Aug 25, 2025

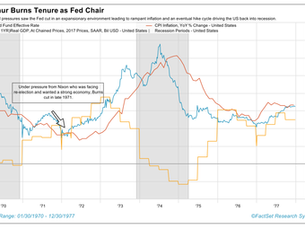

Federal Reserve Sovereignty – An Important Issue

On July 16, capital markets went through a period of whipsaw trading as speculation emerged that President Donald Trump might “fire” Federal Reserve Chairman Jerome Powell. Later that day, the president stated he wasn’t going to remove Powell unless he found “cause.” Do the cost overruns tied to renovations at the Federal Reserve building in […]

Jeff Krumpelman, CFA®

Aug 5, 2025

When It Rains, It Pours – Better Bring an Umbrella

We all know the old saying ‘when it rains, it pours,’ but for many of us the saying ‘it is always sunnier after the rain’ feels more accurate. More often than not, bad times give way to good times and our past struggles become the roadblocks for future happiness. We shouldn’t be faulted for this […]

Christian Hutchins CFP®, CEPA®, AIF®

Jul 29, 2025

Q2 Market Review

If the second quarter of 2025 proved anything, it was Graham’s wisdom in action. While media noise and policy surprises stirred investor anxiety, the market ultimately weighed earnings, economic resilience, and forward momentum—and found substance worth rallying around.

Christian Hutchins CFP®, CEPA®, AIF®

Jul 29, 2025

Sprinting Into the Locker Room at Half-Time! Is this Real or Fear of Missing Out?

No doubt about it, the market is exhibiting some mojo as we close out the first half of 2025. The S&P 500 had an outstanding June, with a total return of roughly 5% for the month. This was on the heels of a more than 6% total return in May, which made for one of […]

Jeff Krumpelman, CFA®

Jul 3, 2025

May Market Review

If there was ever a month that showcased the wisdom of the Oracle of Omaha, May 2025 delivered. Despite a barrage of negative headlines—ranging from tariff disputes and inflation data to consumer spending slowdowns and bond volatility—investors who stayed the course were handsomely rewarded. Buffett’s remark, often seen as clever market banter, became a case study in real time.

Christian Hutchins CFP®, CEPA®, AIF®

Jun 18, 2025

It’s All in the Data

The financial advisory business has changed dramatically over the last 30 years. Early on, a financial advisor was, for the most part, a converted stock or insurance broker looking to move away from a transaction-based business model. The rise of mutual funds and managed portfolios made this transition easier, but at its core, the job […]

Christian Hutchins CFP®, CEPA®, AIF®

Jun 18, 2025

Your Data is for Sale. Your Privacy is Too.

In today’s digital world, we rely on the internet’s convenience to solve problems we didn’t even know we had. On a cold and wet night in February, Amazon and Google seem to instinctively know that you need a new parka to get through six more weeks of winter (thanks, Punxsutawney Phil). What feels like coincidence […]

Christian Hutchins CFP®, CEPA®, AIF®

Jun 18, 2025

Don’t Lose Your Community Property State Benefits

The saying “what is mine, is yours” is a lovely and generous gesture, but might be far from the truth. In forty-one states, “what is mine, is mine” and “your debt, is yours” is a more accurate statement. The remaining nine states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin), treat the […]

Christian Hutchins CFP®, CEPA®, AIF®

Jun 16, 2025

2025 Q1 Market Recap

Market Performance for Q1 2025 S&P 500-4.3% NASDAQ-10.5% DOW 30-1.3% After a historic run over the past two years, U.S. equity markets hit more than a few speed bumps to kick off 2025. Concerns over tariffs, economic growth, and a significant spike in global uncertainty weighed heavily on investors. The S&P 500 and Nasdaq Composite […]

Christian Hutchins CFP®, CEPA®, AIF®

Jun 11, 2025

A Roller Coaster Start to 2025 — Time to Regroup for the Second Half

“Knowledge speaks, but wisdom listens,” said legendary guitarist Jimi Hendrix—a fitting reminder as we reflect on the wild ride that has been the first half of 2025. It turns out we were quite serious when we discussed the likely virulent swings in policy rhetoric out of Washington and the associated turbulence in stock price activity. […]

Jeff Krumpelman, CFA®

Jun 6, 2025

April Market Review

Market Performance for the Month of April S&P 500-0.67% NASDAQ0.88% DOW 30-3.08% All economic numbers and information discussed in this article are provided by our research partners Bespoke and YCharts. If there’s one word to describe the stock market over the past few months, it’s volatile. Within this year, we have experienced a 15% market […]

Christian Hutchins CFP®, CEPA®, AIF®

Jun 2, 2025

Family Traditions

As we close out April, it’s hard for me to reflect on the past month without thinking about family traditions. Every year, April kicks off with the Masters golf tournament in Augusta, Georgia, which to me, a poor golfer with no affinity for the Golf Channel, has always stood as the pinnacle of tradition in […]

Christian Hutchins CFP®, CEPA®, AIF®

Jun 2, 2025

Avoid Whiplash! Sharp Rally Highlights Importance of Balanced Positioning

As management theorist and author Peter Drucker said, “The greatest danger in times of turbulence is not the turbulence, it is to act with yesterday’s logic.” April saw a whirlwind of surprising news flow causing investors to suffer a commensurate roller coaster ride in stock price behavior. Let’s review April’s catalytic events and associated price […]

Jeff Krumpelman, CFA®

May 2, 2025

Respect Rising Risk and Volatility, but Hold Your Ground

Stock price behavior felt a little crazy in March, sort of like the madness of a recent college basketball tournament, as the S&P 500 index declined in price by roughly 5.8% for the month and the tech laden Nasdaq composite index price was off roughly 8.2%.1 It got even crazier in early April following the President […]

Jeff Krumpelman, CFA®

Apr 7, 2025

Clear Air Turbulence or an Ugly Lasting Storm? Hold your Ground!

2025 has simply been boring and status quo, right? There’s not much going on in the world or in the headlines. Not! We want to make sure you are awake as you start to read this. As we anticipated, the amount of news flowing out of Washington on the policy front this year has been […]

Jeff Krumpelman, CFA®

Mar 6, 2025

bottom of page